Separate federal agencies released two final rules that will potentially have a huge impact on employers.

Separate federal agencies released two final rules that will potentially have a huge impact on employers.

Combined, The Federal Trade Commission’s (FTC) final rule banning non-competes along with the Department of Labor’s (DOL) update to overtime salary exemptions, could impact hiring contracting, job classifications, wages, and the stability of employment relationships.

Both rulings are expected to face significant challenges in federal courts, which could delay or stop implementation. Still, employers need to be informed and prepared.

Why Did the FTC Bar Non-Compete Clauses?

According to the Federal Trade Commission, the nationwide ban on non-competes is designed to protect, “the fundamental freedom of workers to change jobs, increasing innovation, and fostering new business formation.”

The agency predicts that increased mobility – an estimated 18% of American workers currently have a non-compete agreement – will increase annual earnings for all workers by an average of $524 per year. An increase in overall wages and a renewed focus on retention strategies are just two issues that require an employer’s attention thanks to this new rule.

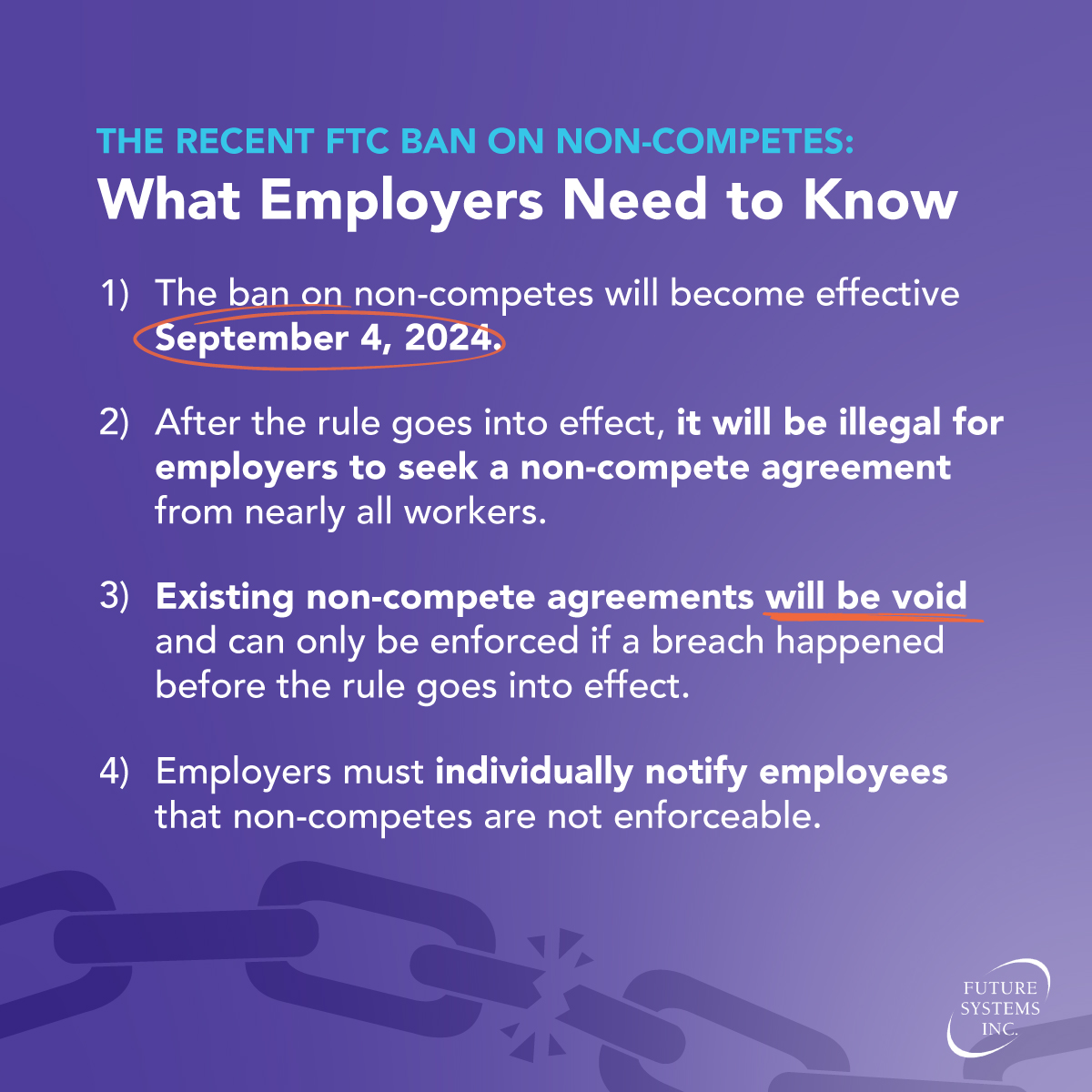

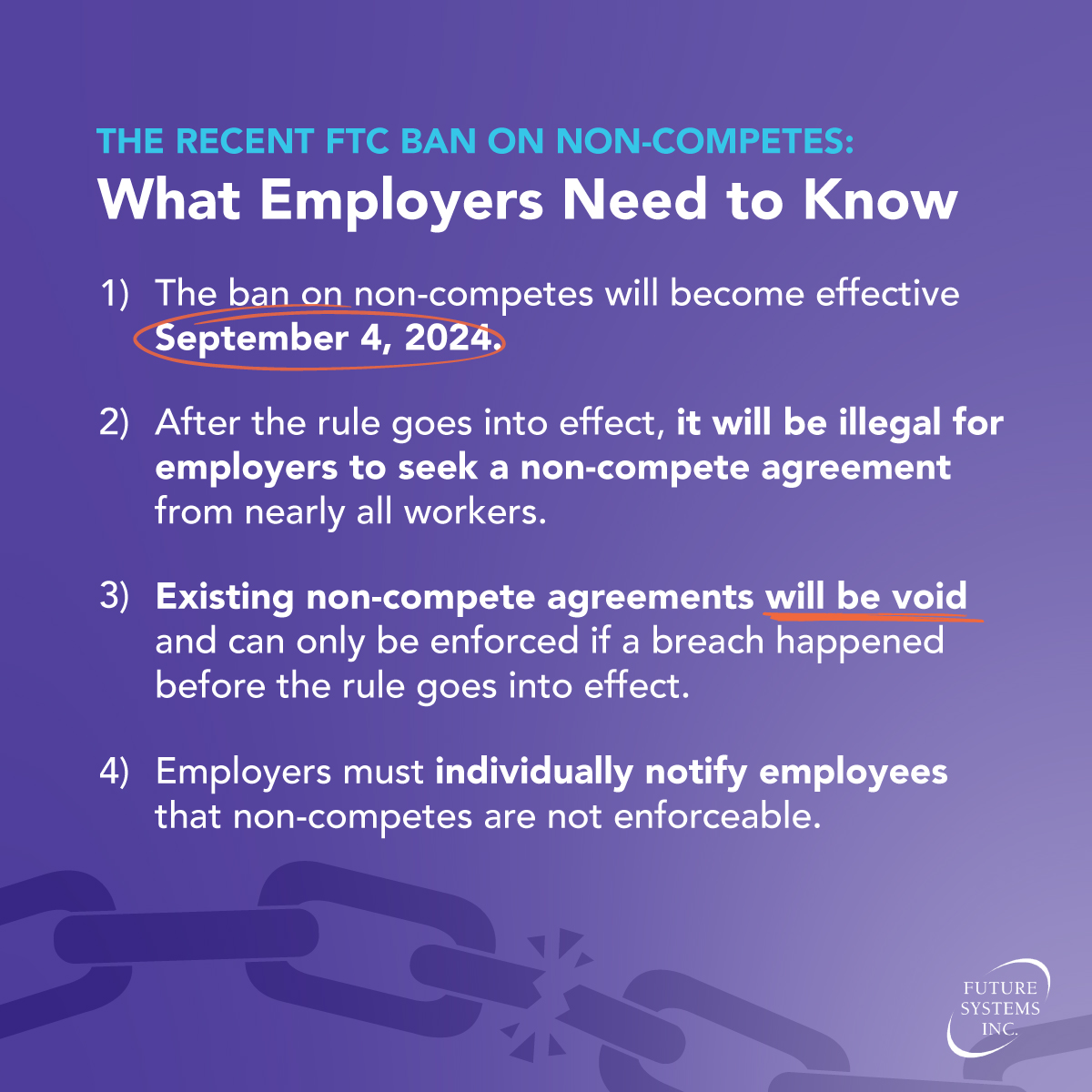

What Employers Need to Know About Non-Competes

- The rule banning new non-competes and eliminating enforcement of existing non-compete agreements will take effect 120 days after it is published, which is Sept. 4, 2024.

- After the rule goes into effect, it will be illegal for employers to seek a non-compete agreement from nearly all workers.

- Existing non-compete agreements will be void and can only be enforced if a breach happened before the rule goes into effect.

- Employers must individually notify

employees that non-competes are not enforceable. The FTC has drafted model language for notices in several languages.

employees that non-competes are not enforceable. The FTC has drafted model language for notices in several languages.

- There are limited exceptions to the rule:

- “Senior Executives” who meet specific salary and job role thresholds may not sign new non-competes, but existing contracts are valid.

- The ban cannot be applied to entities over which the FTC lacks jurisdiction. This includes certain banks, savings and loan institutions, federal credit unions, common carriers, air carriers, foreign air carriers, and those subject to the Packers and Stockyards Act.

- Non-compete agreements are allowed as part of the sale of a business.

- Workers at non-profits, which aren’t governed by the FTC, may still sign noncompete agreements.

What Employers Need to Do About Non-Competes

- Evaluate if you have employees who currently qualify as “Senior Executives,” or if there are workers who should be elevated to that status and consider having them sign a non-compete agreement before the rule goes into effect.

- Prepare the required official notices for all applicable individuals, but do not send them until the rule officially goes into effect – something that may be delayed or stopped entirely, which we will cover shortly.

Why did DOL Change Federal Overtime Rules?

Overtime rules have been enshrined as part of the Fair Labor Standards Act (FLSA) since 1938, and exist as a tool to protect workers from exploitation. According to the DOL, “Strong overtime protections help build America’s middle class and ensure that workers are not overworked and underpaid.”

What Employers Need to Know About Overtime

A worker who is exempt from receiving overtime pay typically falls into one of two categories.

Executive, administrative, or professional (EAP) employees must satisfy all requirements of a three-factor test to be considered exempt.

Executive, administrative, or professional (EAP) employees must satisfy all requirements of a three-factor test to be considered exempt.

- The employee is paid a salary.

- The salary is not less than the minimum salary threshold amount.

- The employee primarily performs executive, administrative, or professional duties.

- Highly compensated employees (HCE) must satisfy at least one of three requirements to be classified as exempt.

- The employee’s primary duty includes performing office or non-manual work.

- The salary is not less than the minimum salary threshold amount.

- The employee customarily and regularly performs at least one of the exempt duties or responsibilities of an exempt executive, administrative or professional employee.

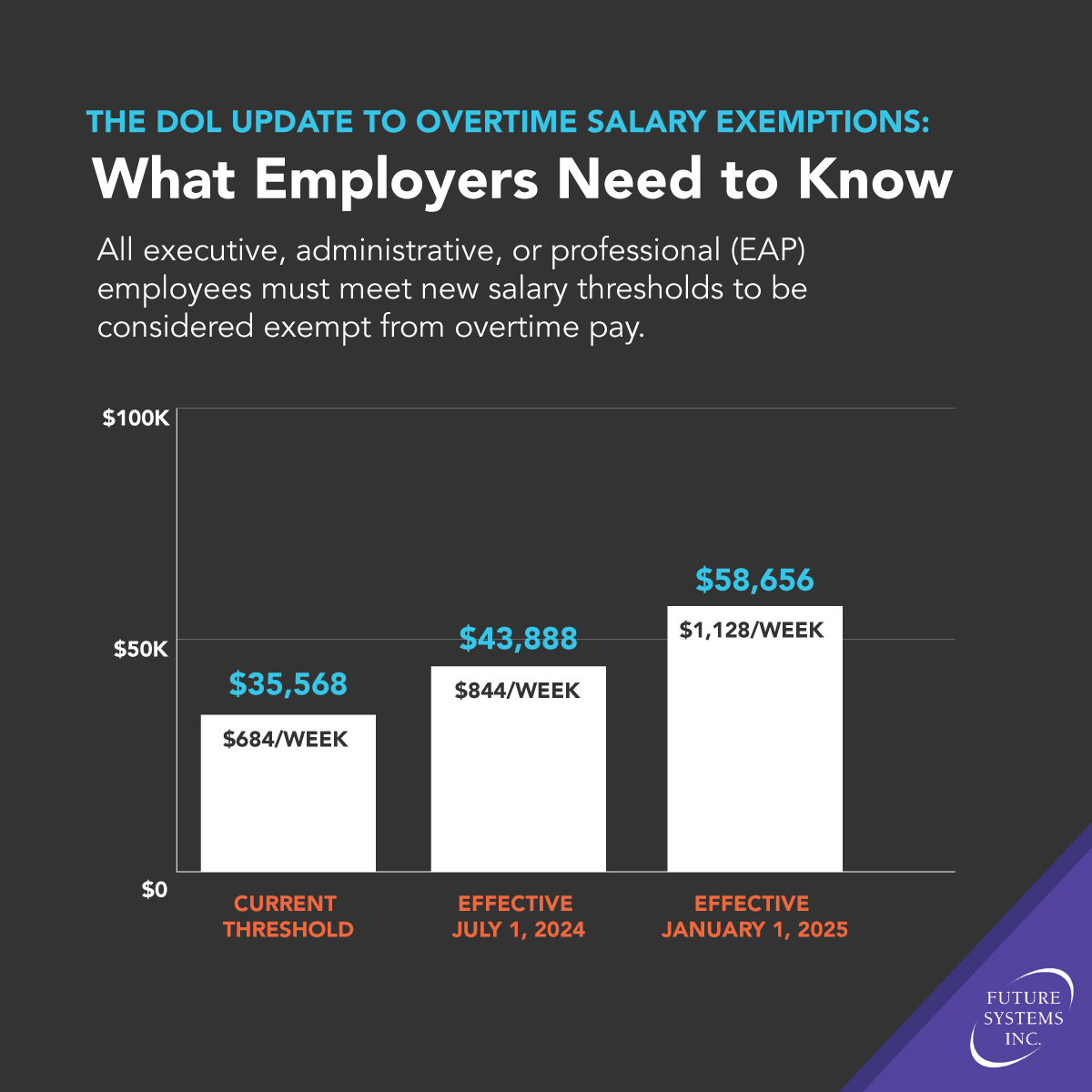

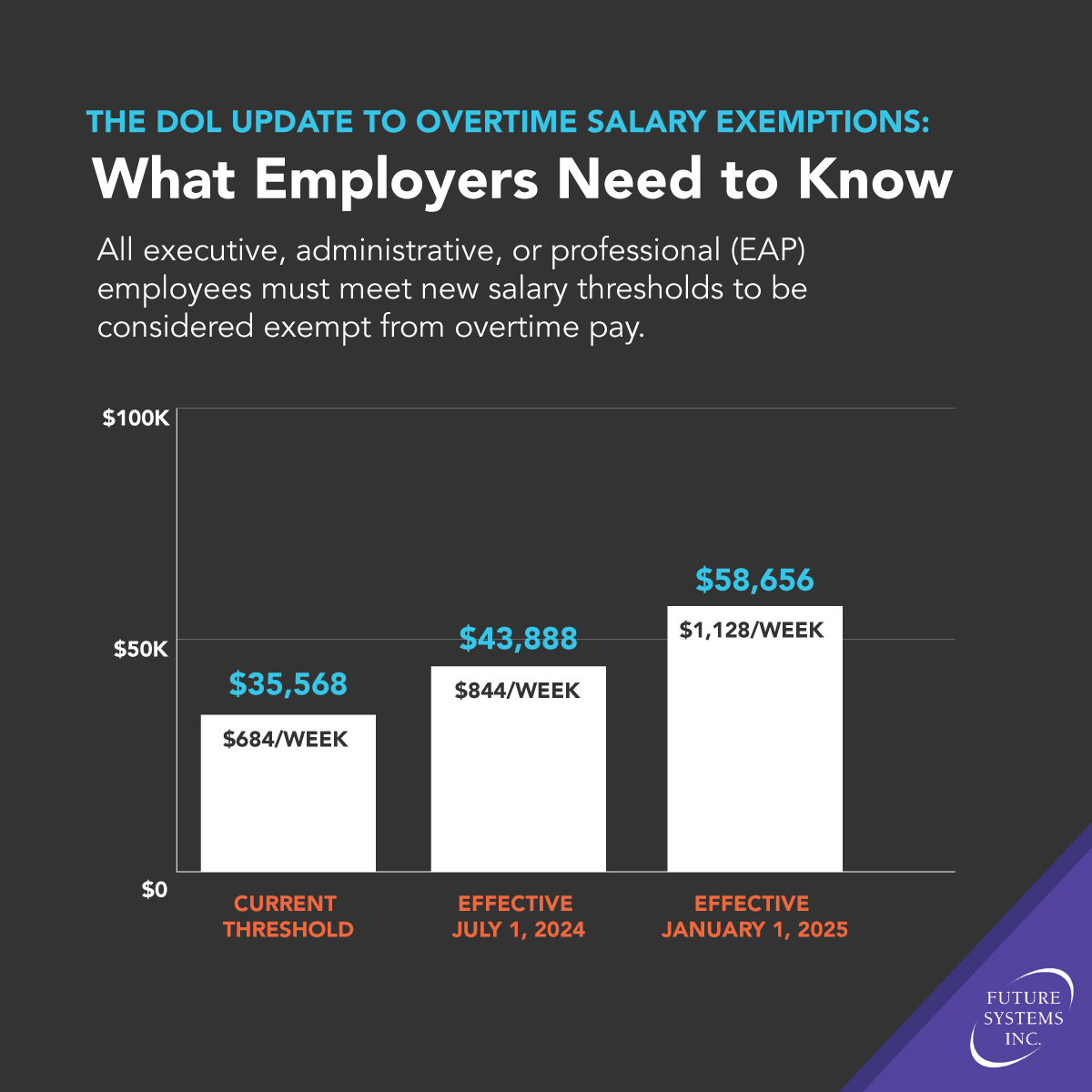

The minimum salary threshold has received many updates, but due to the increased time between updates over the last 50 years, DOL has now dictated two stages for raising the minimum salary thresholds for EAP and HCEs, and codified further threshold increases every three years beginning July 1, 2027.

- EAP

- Current threshold: $684 per week; $35,568 annually for a full-time hourly worker

- Effective July 1, 2024: $844 per week; $43,888 annually for a full-time hourly worker

- Effective January 1, 2025: $1,128 per week; $58,656 annually for a full-time hourly worker

- HCE

- Current threshold: $107,432 per year

- Effective July 1, 2024: $132,964 per year

- Effective January 1, 2025: $151,164

What Employers Need to Do About Overtime

- Analyze Workforce for FLSA Compliance: Conduct a thorough review of current employee salaries, hours worked, and job duties. This will identify employees potentially impacted by the new salary threshold for exempt status.

- Adjust Employee Classifications (if needed): Following the review, determine if any employees need reclassification from exempt to non-exempt to comply with the new rules. This may involve a salary increase or reclassification to make them eligible for overtime pay. Be mindful of how employees might perceive this change. In particular, managers and supervisors may interpret a move from “exempt” status to “non-exempt” as a demotion.

- Manage Benefit Changes for Reclassified Employees: If vacation, sick leave, or other benefits differ between exempt and non-exempt employees, develop a plan to transition reclassified employees to the appropriate programs.

- Evaluate Bonus and Benefits Impacts on Exempt Status: Analyze how non-salary compensation (bonuses, incentives, commissions) factors into the new FLSA salary threshold for exemption. The FLSA dictates how these are included in total annual compensation, potentially affecting exemption status.

- Review All Policies for Potential Differences: Review all company policies that may differ between exempt and non-exempt employees to ensure compliance and avoid inconsistencies.

- Implement Time Tracking for Non-Exempt Employees: Establish or update timekeeping procedures for newly reclassified non-exempt employees to accurately track their hours worked. Accurate timekeeping is vital for managing overtime and FLSA adherence.

- Update Overtime Approval Policies: Revise your company's overtime policies to reflect changes in employee classifications. Include clear procedures for requesting and approving overtime to ensure effective management and budgeting.

- Honor Contractual Obligations: Remember, the FLSA is a federal law, but existing employment contracts with specific salary agreements may still apply. You may need an attorney to ensure contracts and the law are being adhered to.

- Comply with State Wage Change Notice Requirements: Some states require advance notice of wage changes. Check your local regulations for specific requirements. Regardless of state law, communicate any changes in employment terms before they take effect.

Expect Legal Delays to New Federal Rulings

While there are many potential changes to review, you may notice that we have not directed you to make any immediate adjustments to wages, benefits, or policies.

Both rules are expected to be contested in court by states and business advocacy groups. For example, a Dallas tax firm moved to challenge the FTC’s ruling before a Texas federal court shortly after it was announced.

If any of these current or future challenges result in an injunction, the new rules will face significant delays and could be shot down entirely. In 2016, for instance, a federal judge in Texas stopped an increase to the wage threshold only a few days before the change was to take effect.

However, if the rules take effect and your business is not in compliance, the penalties will be more than frustrating.

When local, state, or federal laws change, Future Systems not only keeps our clients aware of compliance issues, but we also have the tools to help your business implement changes at scale with ease. Get prepared and reach out today.

Separate federal agencies released two final rules that will potentially have a huge impact on employers.

Separate federal agencies released two final rules that will potentially have a huge impact on employers. employees that non-competes are not enforceable. The FTC has drafted model language for notices in several languages.

employees that non-competes are not enforceable. The FTC has drafted model language for notices in several languages. Executive, administrative, or professional (EAP) employees must satisfy all requirements of a three-factor test to be considered exempt.

Executive, administrative, or professional (EAP) employees must satisfy all requirements of a three-factor test to be considered exempt.